#rethinkcompliance Blog

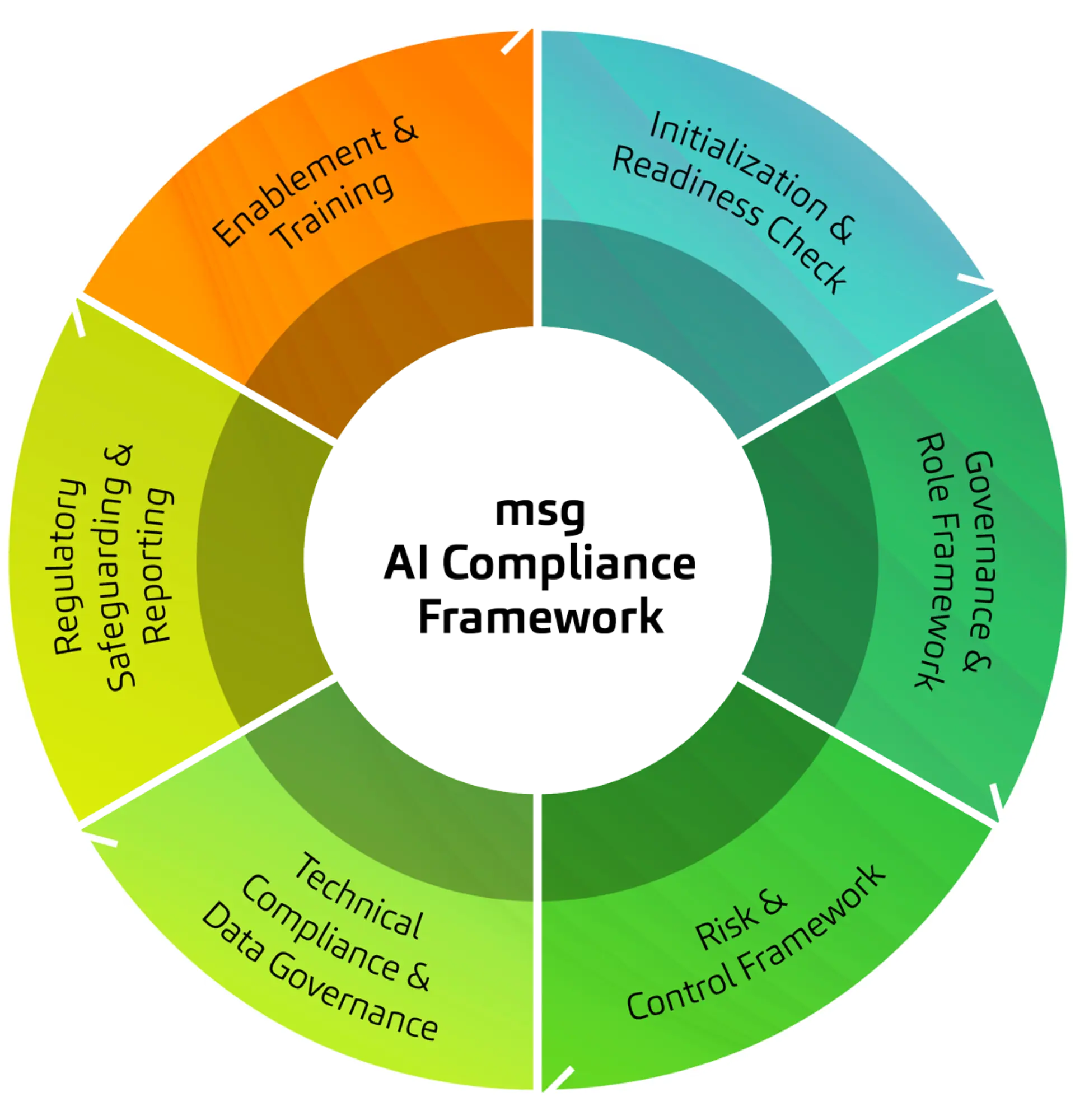

Combining technology, governance, and expertise can turn a regulatory duty into true efficiency and a lasting competitive edge.

#rethinkcompliance Blog

Extracting insights from complex regulations like the AML Act is tough. We compare two AI-powered methods that improve precision and usability in compliance document analysis.

#rethinkcompliance Blog

Streamline regulatory workflows and reduce errors using AI. Discover how RAG, AI agents, and Graph Databases transform compliance document analysis—faster, more accurate, and fully explainable.

#rethinkcompliance Blog

Enhancing the resilience of the risk and compliance program has become a growing requirement among auditors and regulators, as reflected in numerous legislative frameworks. The challenge resides in successfully transitioning to a digital format while achieving efficiency amidst ever growing volatility. The implementation of automation, alongside artificial intelligence and effectively coordinated policies and procedures, contributes significantly to the optimization of this process.