BANKING.VISION Blog

(German-language blog post) On 7 August 2025, the European Banking Authority (EBA) launched a consultation on its revised Guidelines on internal governance. The draft aligns with the CRD VI banking package and other regulations such as the Digital Operational Resilience Act (DORA). It introduces clearer role descriptions, extends scope to third-country branches, and strengthens regulatory monitoring as part of MaRisk compliance.

#rethinkcompliance Blog

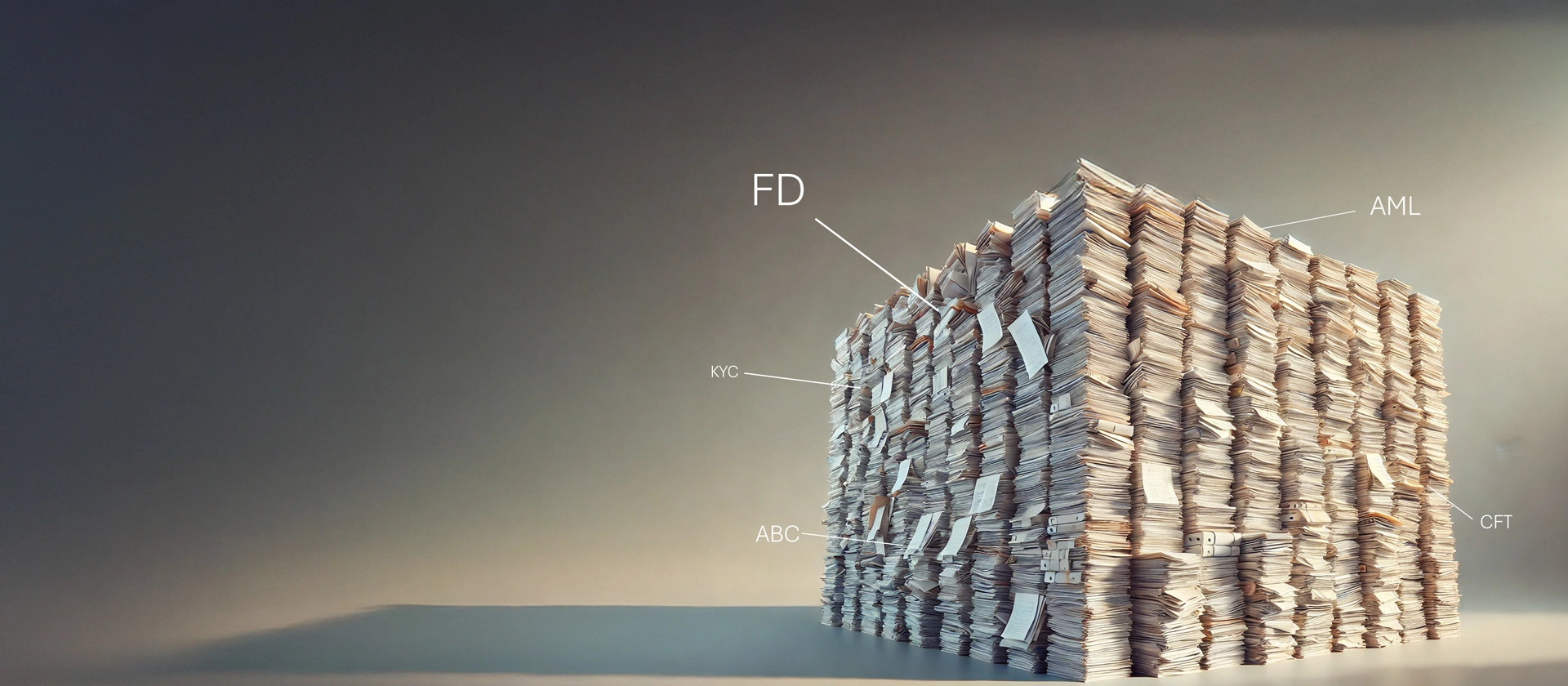

BaFin rejects implementing EBA Guidelines EBA/GL/2024/14 & /15 – insights on reasoning, background, and implications for German financial institutions.

#rethinkcompliance Blog

Combining technology, governance, and expertise can turn a regulatory duty into true efficiency and a lasting competitive edge.

#rethinkcompliance Blog

New EBA guidelines raise the bar for sanctions compliance. Find out what financial institutions must prepare for by the end of 2025 – and how to take a structured approach today.