Successfully Implementing Sanctions Requirements

We support you with governance, risk assessment, and technical implementation in line with EBA standards

Sanctions Compliance: Effectively Implementing the EBA Guidelines

Mit den neuen EBA-Leitlinien steigen die regulatorischen Anforderungen an Finanzinstitute zur Umsetzung von EU- und nationalen Sanktionsmaßnahmen deutlich. Wir unterstützen Sie dabei, diese Vorgaben praxisnah, risikoorientiert und zukunftssicher in Ihre Prozesse und Governance-Strukturen zu integrieren.

Background & Challenges

On 30 December 2025, the binding guidelines issued by the European Banking Authority (EBA) will enter into force. Their objective is to raise the implementation of sanctions measures across financial institutions to a uniformly high standard. The requirements go far beyond technical screening systems – they address corporate governance, organizational structures, and risk analysis frameworks.

Institutions are required to:

- Establish and adopt strategies and processes for sanctions compliance, approved by the management body

- Appoint a responsible member of the management board or a qualified senior officer

- Conduct an institution-wide sanctions threat analysis annually (or in response to relevant events)

- Operate suitable screening systems with documented calibration and performance monitoring

- Ensure efficient and transparent processes for hit analysis and reporting of suspicious cases

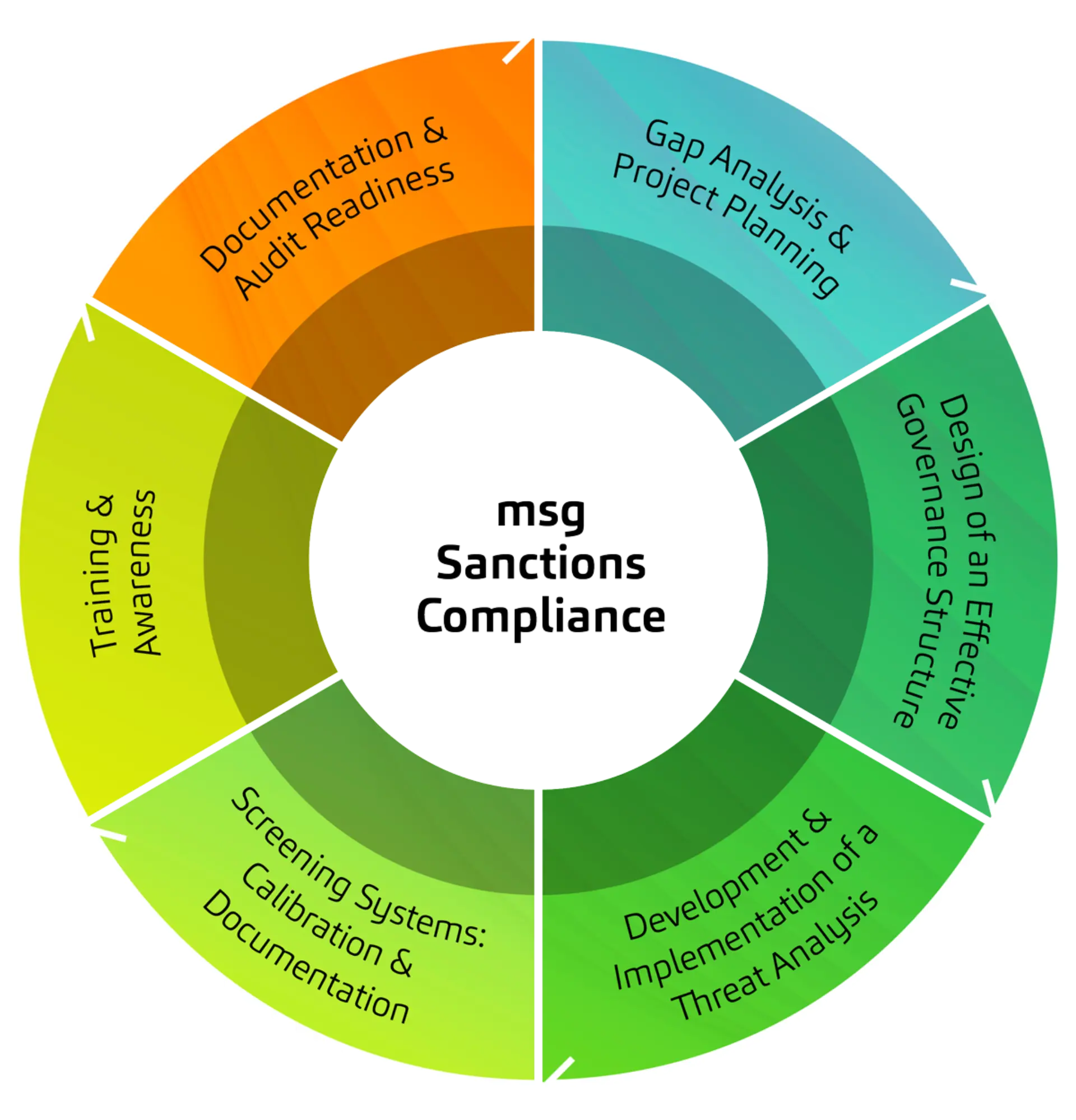

Our Offering: msg Sanction Compliance

Assessing your current setup and identifying areas of action for implementing the EBA guidelines.

Developing clear roles, responsibilities, and reporting lines – in close alignment with your AML functions.

Preparing risk-based threat analyses considering geographical, customer-related, and product-specific factors.

Advising on the selection, optimization, and audit-readiness of your screening systems in line with regulatory expectations.

Practical training programs for all relevant functions – from first-line staff to senior management.

Producing comprehensive, audit-proof documentation for internal and external supervisory bodies.

Your Benefits

✔ Early implementation ahead of the official enforcement date

✔ Reduced reputational, liability, and sanction risks

✔ Sustainable integration into your existing compliance framework

✔ Industry expertise from projects with banks, insurers, and financial service providers

Follow-up: EBA Guidelines on the Implementation of EU and National Sanctions Measures

BaFin rejects implementing EBA Guidelines EBA/GL/2024/14 & /15 – insights on reasoning, background, and implications for German financial institutions.

EBA Guidelines on the Implementation of EU and National Sanctions Measures

New EBA guidelines raise the bar for sanctions compliance.

Find out what financial institutions must prepare for by the end of 2025 – and how to take a structured approach today.