Optimise your compliance risk strategy with a solution that automates your backtesting process.

As a financial institution, you are obliged to review the functioning and effectiveness of your internal measures to prevent money laundering. Indicators, rules, thresholds, scores and risk classifications used in monitoring systems need to be checked on a regular and ad hoc basis to ensure that they are appropriate and up to date. Well-tuned systems generate high quality hits. However, empirical knowledge alone is no longer sufficient to optimise the business configuration. Backtesting simulates the effects of parameter changes and helps to calibrate the monitoring system correctly. We support you in backtesting - and automate the process for you as far as possible!

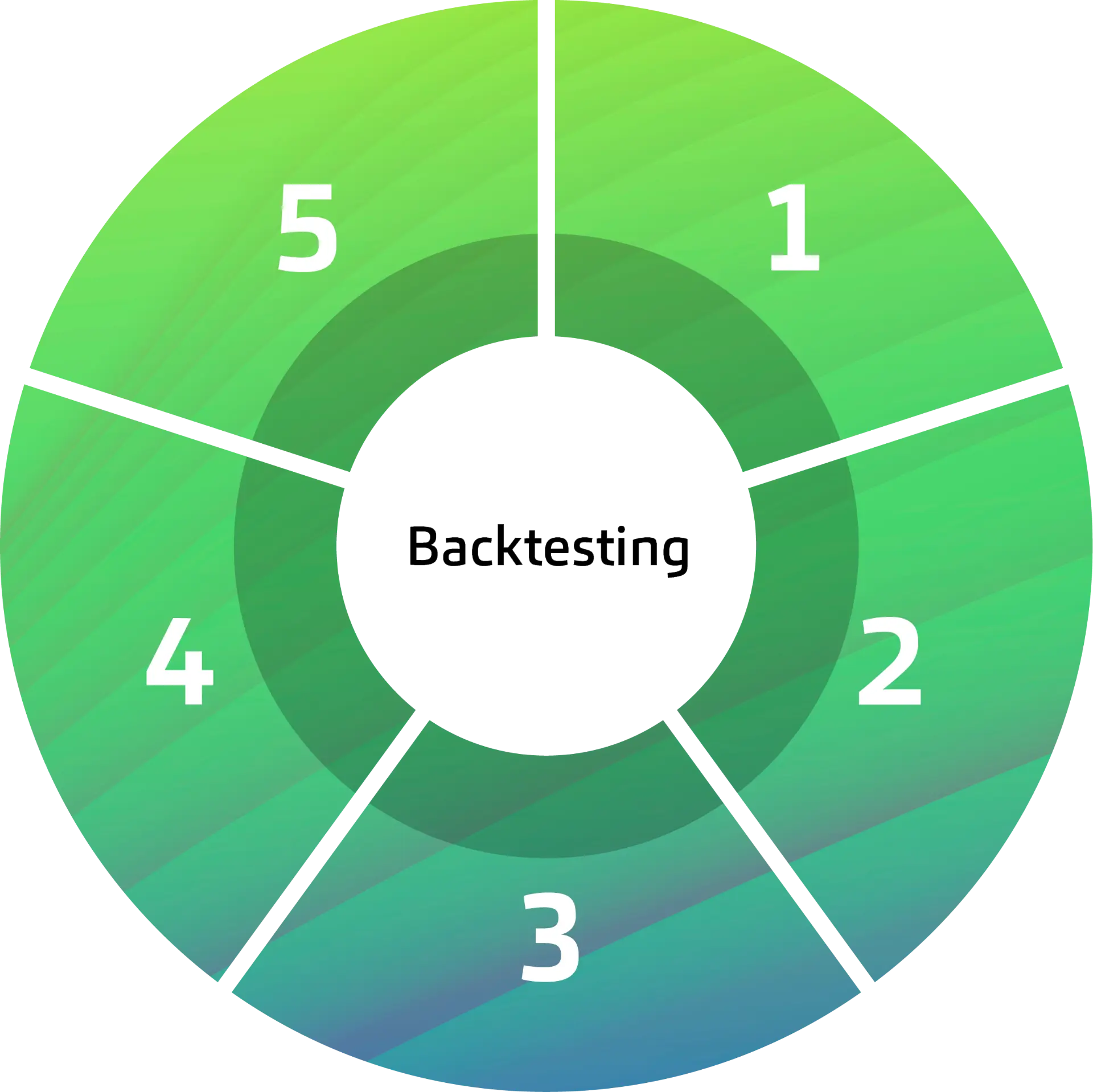

Proper backtesting

Services at a glance

1 | Analysing risk parameters

2 | Selecting data and checking data quality

3 | Preparing to backtest

4 | Running the backtesting process

5 | Adjusting and optimising risk parameters

Your advantages

Avoid findings during audits by providing comprehensible and documented analyses of the thresholds and other risk parameters to be audited.

Reduce false positive rates and identify new, previously undetected cases with an optimally tuned monitoring system.

Benefit from the many years of experience of our experts, who not only have in-depth compliance know-how, but are also very familiar with your monitoring systems - both technically and professionally.

Data sheet

As a financial institution, you are obliged to review the functioning and effectiveness of your internal measures to prevent money laundering. Indicators, rules, thresholds, scores and risk classifications used in monitoring systems need to be checked on a regular and ad hoc basis to ensure that they are appropriate and up to date.